|

Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. State Tax Changes Taking Effect January 1, 2023. Return to R&D Expensing Crucial for Manufacturing and. Technology Investment. The Latest on the Global Tax Agreement: The EU Adopts Pillar Two. Prospects for Federal Tax and Budget Policy after the 2022 Midterms. 2023 State Business Tax Climate Index. International Tax Competitiveness Index 2022. 10 Tax Reforms for Growth and Opportunity. Eight State Tax. Reforms for Mobility and Modernization. Tariffs Are Taxes Too. Join over 50,000 Subscribers!. Taxes in Everything:. Die Hard Edition. State Tax Changes Taking Effect January 1, 2023. Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. Digital Services Taxes: Is There an End in Sight?. Show

Top 1: Tax FoundationAuthor: taxfoundation.org - 40 Rating

Description: Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. State Tax Changes Taking Effect January 1, 2023. Return to R&D Expensing Crucial for Manufacturing and. Technology Investment. The Latest on the Global Tax Agreement: The EU Adopts Pillar Two. Prospects for Federal Tax and Budget Policy after the 2022 Midterms. 2023 State Business Tax Climate Index. International Tax Competitiveness Index 2022. 10 Tax Reforms for Growth and Opportunity. Eight State Tax. Reforms for Mobility and Modernization. Tariffs Are Taxes Too. Join over 50,000 Subscribers!. Taxes in Everything:. Die Hard Edition. State Tax Changes Taking Effect January 1, 2023. Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. Digital Services Taxes: Is There an End in Sight?.

Matching search results: WebAbout Us. The Tax Foundation is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels. ...

Top 2: Gross Domestic Product | U.S. Bureau of Economic Analysis (BEA)Author: bea.gov - 114 Rating

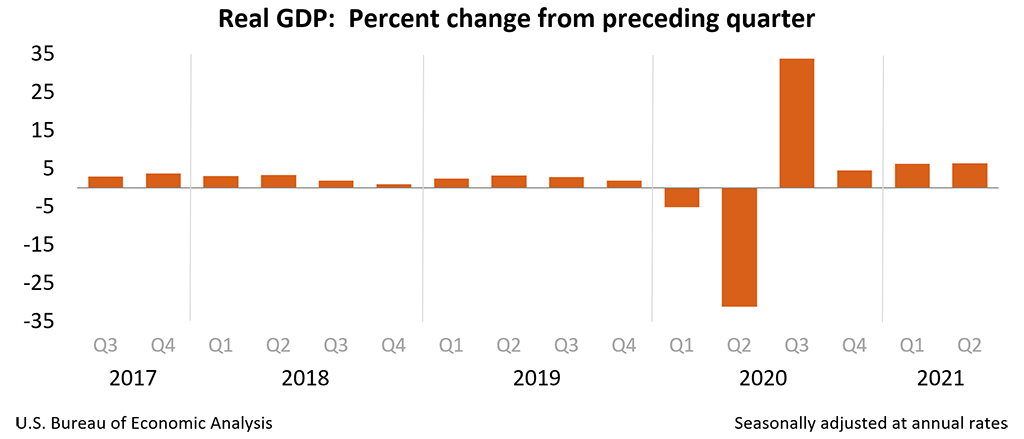

Description: Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, in contrast to a decrease of 0.6 percent in the second quarter. The increase in the third quarter primarily reflected increases in exports and consumer spending that were partly offset by a decrease in housing investment. Profits decreased less than 0.1 percent in the third quarter after increasing 4.6 percent in the second quarter. Private services-producing. industries increased 4.9 perce

Matching search results: WebDec 22, 2022 · Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, in contrast to a decrease of 0.6 percent in the second quarter. ... Profits decreased less than 0.1 percent in the third quarter after increasing 4.6 percent in the second quarter. Private services-producing industries increased 4.9 ... ...

Top 3: Publication 590-B (2021), Distributions from Individual Retirement ...Author: irs.gov - 108 Rating

Description: Publication 590-B - Introductory Material. 3. Disaster-Related Relief. Publication 590-B - Additional Material. Jim’s Illustrated 2021 QCD Adjustment Worksheet. Jim’s Illustrated 2022 QCD Adjustment Worksheet. Worksheet 1-1. Figuring the Taxable Part of. Your IRA Distribution. Worksheet 1-1. Figuring the Taxable Part of Your IRA Distribution—Illustrated. Illustrated Recapture Amount—Allocation Chart. Appendix A-1.Worksheet for Determining Required Minimum Distributions. Appendix A-2.Worksheet for Determining Required Minimum Distributions. Appendix C. Recapture Amount—Allocation Chart. Appendix C. Recapture Amount—Allocation Chart (Continued). Appendix D. Qualified Charitable Deduction (QCD) Adjustment Worksheet. Table I-1. Using This Publication. What if You Inherit an IRA?. When Can You Withdraw or Use Assets?. When Must You Withdraw Assets? (Required Minimum Distributions). Which Table Do You Use To Determine Your Required Minimum Distribution?. What Age(s) Do You Use With the Table(s)?. Miscellaneous Rules for Required Minimum Distributions. Are Distributions Taxable?. Distributions Fully or Partly Taxable. Figuring the Nontaxable and Taxable Amounts. Other Special IRA Distribution Situations. Reporting and Withholding Requirements for Taxable Amounts. What Acts Result in Penalties or Additional Taxes?. Prohibited Transactions. Investment in Collectibles. Unrelated Business Income. Excess Accumulations (Insufficient Distributions). Reporting Additional Taxes. Are Distributions Taxable?. What Are Qualified Distributions?. Additional Tax on Early Distributions. Ordering Rules for Distributions. How Do You Figure the Taxable Part?. Must You Withdraw or Use Assets?. Distributions After Owner's Death. Qualified Disaster Distributions. Taxation of Qualified Disaster Distributions. Repayment of Qualified Disaster Distributions. Repayment of Qualified 2018, 2019, and 2020 Distributions for the Purchase or Construction of a Main Home. Coronavirus-Related. Distributions. The Taxpayer Advocate Service (TAS) Is Here To Help You. How Can You Learn About Your Taxpayer Rights?. What Can TAS Do for You?. How Else Does TAS Help Taxpayers?. TAS for Tax. Professionals. Low Income Taxpayer Clinics (LITCs). Figuring the Owner's Required Minimum Distribution. Owner Died on or After Required Beginning Date. Owner Died Before Required Beginning Date. Figuring the Beneficiary's Required Minimum Distribution. Transactions Not Prohibited. Repayment of Qualified Coronavirus-Related Distributions.

Matching search results: WebIf an IRA owner dies after reaching age 72, but before April 1 of the next year, no minimum distribution is required for that year because death occurred before the required beginning date. For tax years 2019 and earlier, you were required to begin receiving distributions by April 1 of the year following the year in which you reached age 70½. ...

Top 4: Statistics Explained - European CommissionAuthor: ec.europa.eu - 102 Rating

Description: Did you know that..... Welcome To Statistics Explained . New / updated articles. Looking for an article on a specific theme. Looking for an article on a specific theme. New / updated articles Did you know that....In 2021, in the EU, the average age of young people leaving their parental home was 26.5 years. Read more... Welcome To Statistics Explained Statistics Explained, your guide to European statistics. Statistics Explained is an official Eurostat website. presenting statistical topics in

Matching search results: WebStatistics Explained, your guide to European statistics. Statistics Explained is an official Eurostat website presenting statistical topics in an easily understandable way. Together, the articles make up an encyclopedia of European statistics for everyone, completed by a statistical glossary clarifying all terms used and by numerous links to further information … ...

Top 5: What is Adjusted Gross Income (AGI)? - TurboTaxAuthor: turbotax.intuit.com - 142 Rating

Description: File 100% FREE with expert help. Adjustments to income. Impact on deductions and credits. Other. AGI implications. TaxCaster Tax Calculator. Tax Bracket. Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopUpdated for Tax Year 2022 • December 1, 2022 09:15 AMOVERVIEWAdjusted gross income (AGI) can directly impact the deductions and credits you are eligible for, which can wind up reducing the amount of taxable income you report on your t

Matching search results: WebDec 01, 2022 · AGI Overview. When preparing your tax return, you probably pay more attention to your taxable income than your adjusted gross income (AGI). However, your AGI is also worthy of your attention, since it can directly impact the deductions and credits you’re eligible for—which can wind up reducing the amount of taxable income you report … ...

Top 6: Gross Domestic Product, Second Quarter 2021 (Advance …Author: bea.gov - 163 Rating

Description: Source Data for the Advance Estimate. Annual Update of the National Economic Accounts. Updates for the First Quarter of 2021 Real gross domestic product (GDP) increased at an annual rate of 6.5 percent in the second quarter of 2021 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent (revised).The GDP estimate released today is based on source data that are incomplete or subject to further revision by th

Matching search results: WebJul 29, 2021 · Real gross domestic product (GDP) increased at an annual rate of 6.5 percent in the second quarter of 2021 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent (revised). The GDP estimate released today is based on source data that are … ...

Top 7: What is Gross Income? Definition, Formula, Calculation, and …Author: investopedia.com - 115 Rating

Description: What Is Gross Income? . Understanding Gross Income . How to Calculate Gross Income . Gross Income vs. Net Income . Examples of Gross Income . How. Can I Calculate Personal Gross Income?. What Is the Difference Between Gross and Net Income?. How Do You Calculate Gross Business Income?. What Is My Monthly Gross Income?. Does Gross Income Include Taxes?. Individual Gross Income . Business Gross Income . Individual Gross Income Example . Business Gross Income Example What Is Gro

Matching search results: WebJul 11, 2022 · Gross income, or gross pay, is an individual's total pay before accounting for taxes or other deductions. At the company level, it's the company's revenue minus the cost of good sold . In this ... ...

Top 8: IRS Free File: Do your Taxes for Free - IRS tax formsAuthor: irs.gov - 120 Rating

Description: Choose from IRS Free File:. What Is IRS Free File?. Guided Tax. Preparation (for AGI $73,000 or less). How IRS Free. File Offers Work. About IRS Free File Partnership with Online Tax Preparation Companies. What You Need to Get Started. Related Tools and Information. The Benefits of the Free File Program to You: BodyWelcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free

Matching search results: WebNov 21, 2022 · IRS Free File is Now Closed Check back January 2023 to prepare and file your federal taxes for free. ... This is the fastest and easiest way to view your prior year adjusted gross income (AGI) and access your tax records. ... Always remember to print your return after you successfully file online. If you forget to print your return, ... ...

Top 9: Free Paycheck Calculator: Hourly & Salary Take Home After TaxesAuthor: smartasset.com - 111 Rating

Description: Federal Paycheck Calculator. How Your Paycheck Works: Income Tax Withholding. How Your Paycheck Works: FICA Withholding. How Your Paycheck Works: Deductions. How Your Paycheck Works: Pay Frequency. How Your Paycheck Works: Local Factors. Federal Top Income Tax Rate. 2022 - 2023 Income Tax Brackets Federal Paycheck CalculatorPhoto credit: ©iStock.com/RyanJLaneFederal Paycheck Quick FactsFederal income tax rates range from 10% up to a top marginal rate of 37%.The U.S. real median household income

Matching search results: WebThese are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401(k) or 403(b). So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck. ...

Top 10: Retirement Topics - Exceptions to Tax on Early DistributionsAuthor: irs.gov - 167 Rating

Description: Exception. to 10% Additional Tax. **Qualified public safety employees Most retirement plan distributions are subject to income tax and may be subject to an additional 10% tax.Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called ”early” or ”premature” distributions. Individuals must pay an additional 10% early withdrawal tax unless an exception applies.Exception. to 10% Additional Tax. ExceptionThe distribution will NOT be subject to the 1

Matching search results: WebMost retirement plan distributions are subject to income tax and may be subject to an additional 10% tax. Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called ”early” or ”premature” distributions. ...

Top 11: Gross Pay vs. Net Pay: What's the Difference? - N26Author: n26.com - 98 Rating

Description: What is gross pay vs. net pay?. What is deducted from gross pay?. How to calculate your gross income. How to calculate net pay from gross pay. Posts that match the following Topic. How to calculate gross income if. you’re a salaried employee. How to. calculate gross income if you’re a wage employee. What is gross salary?. Where do I find my gross salary?. Where do I find my net salary?. How do I calculate my annual gross pay if I’m earning minimum wage? Understanding the difference between gross

Matching search results: Nov 18, 2022 · Gross pay is the amount of money an employee receives from a company before any deductions—such as health insurance, taxes, or student loan ...Nov 18, 2022 · Gross pay is the amount of money an employee receives from a company before any deductions—such as health insurance, taxes, or student loan ... ...

Top 12: Gross Pay Vs. Net Pay: What's The Difference? – Forbes AdvisorAuthor: forbes.com - 125 Rating

Description: Gross Pay vs. Net Pay: Key Differences. Frequently. Asked Questions (FAQs). How To Calculate Gross Pay. How To Calculate Net Pay. Do employers pay gross or net?. What is gross income?. Should gross pay equal salary?. Which is more―net. pay or gross pay?. How do I calculate gross pay from net pay? . Updated: Aug 22, 2022, 3:00pm Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. GettyWhen you hire. your first em

Matching search results: Aug 22, 2022 · Gross pay is the amount an employee earns before all deductions, including taxes, benefits, wage attachments and any other payroll ...Aug 22, 2022 · Gross pay is the amount an employee earns before all deductions, including taxes, benefits, wage attachments and any other payroll ... ...

Top 13: Gross Pay vs. Net Income: What's the Difference? - Capital OneAuthor: capitalone.com - 136 Rating

Description: Is Gross Income Before or After Taxes? Gross pay is the total amount of income you receive as wages before any taxes or other deductions are withheld by your employer. Deductions may include things like federal and state income tax withholding, employee benefit premiums like dental and health insurance, or. 401(k) retirement account contributions. If you’re a salaried employee with one income source, your gross pay is your annual salary before taxes. If you’re an hourly employee with one in

Matching search results: Sep 6, 2022 · Gross income is the amount someone is paid before deductions, such as Social Security taxes or contributions to retirement accounts. And net ...Sep 6, 2022 · Gross income is the amount someone is paid before deductions, such as Social Security taxes or contributions to retirement accounts. And net ... ...

Top 14: Is Gross Income Before or After Taxes? - LinkedInAuthor: linkedin.com - 138 Rating

Description: Is Gross Income Before or After Taxes?. How to Calculate Gross Pay. What Payroll Deductions Affect Net Pay?. How to Calculate Net Pay. Subtract Deductions and Find Net Pay. Final Notes on Gross Pay. Is gross income before or after taxes? Gross income is pay you receive before taxes and any other deductions. Net pay is what appears on your check and bank balance. Knowing the difference can help you budget effectively and start your career on the right financial footing.Is Gross Income Before or

Matching search results: Aug 8, 2022 · Gross income is pay you receive before taxes and any other deductions. Net pay is what appears on your check and bank balance.Aug 8, 2022 · Gross income is pay you receive before taxes and any other deductions. Net pay is what appears on your check and bank balance. ...

Top 15: Gross Pay vs Net Pay: What's the Difference and How to Calculate ...Author: wrapbook.com - 107 Rating

Description: What does gross pay mean for an. hourly employee?. How to calculate gross pay for an hourly employee. How gross pay works: a gross pay example for hourly employees. What does gross pay mean for a salaried employee?. How to calculate gross pay for a salaried employee. How gross pay works: a gross pay example for salaried employees. How to calculate net pay. How to calculate net pay from gross pay. How to calculate gross salary from net salary. How to calculate deductions and taxes from gross and net pay. How to calculate deductions and taxes independently. How net pay works: a net pay example. What is the. difference between gross pay and net pay?. But how do gross pay and net pay affect an employer’s taxes?. Step 1: Calculate voluntary deductions. Step 2: Calculate federal taxes. Step. 3: Calculate any mandatory deductions.

Matching search results: It's that simple. All you have to do is figure out your gross pay and total deductions and taxes, then subtract the latter from the former. The resulting number ...It's that simple. All you have to do is figure out your gross pay and total deductions and taxes, then subtract the latter from the former. The resulting number ... ...

Top 16: What Is Gross Income? - The BalanceAuthor: thebalancemoney.com - 95 Rating

Description: How Gross Income Works . Examples of Gross Income . Gross Income vs. Net Income . Adjusted Gross Income (AGI) . Frequently Asked Questions (FAQs) . How do you calculate gross. income?. What is. adjusted gross income? Key TakeawaysGross income is the amount of money you earn before any taxes or other deductions are taken out.It impacts how much someone can borrow for a home, and it's also used to determine your federal and state income taxes.Your gross income can be from a salary, hourl

Matching search results: Nov 8, 2022 · Gross income is the amount of money you earn before any taxes or other deductions are taken out. Key Takeaways. Gross income is the amount of ...Nov 8, 2022 · Gross income is the amount of money you earn before any taxes or other deductions are taken out. Key Takeaways. Gross income is the amount of ... ...

Top 17: What is Gross Income? Definition, Formula, Calculation, and ExampleAuthor: investopedia.com - 119 Rating

Description: What Is Gross Income? . Understanding Gross Income . How to Calculate Gross Income . Gross Income vs. Net Income . Examples of Gross Income . How. Can I Calculate Personal Gross Income?. What Is the Difference Between Gross and Net Income?. How Do You Calculate Gross Business Income?. What Is My Monthly Gross Income?. Does Gross Income Include Taxes?. Individual Gross Income . Business Gross Income . Individual Gross Income Example . Business Gross Income Example What Is Gro

Matching search results: Jul 11, 2022 · Gross income for an individual—also known as gross pay when it's on a paycheck—is an individual's total earnings before taxes or other ...Jul 11, 2022 · Gross income for an individual—also known as gross pay when it's on a paycheck—is an individual's total earnings before taxes or other ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 paraquee Inc.