|

Choose from IRS Free File:. What Is IRS Free File?. Guided Tax. Preparation (for AGI $73,000 or less). How IRS Free. File Offers Work. About IRS Free File Partnership with Online Tax Preparation Companies. What You Need to Get Started. Related Tools and Information. The Benefits of the Free File Program to You:. . BodyWelcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free Show

Top 1: IRS Free File: Do your Taxes for Free - IRS tax formsAuthor: irs.gov - 120 Rating

Description: Choose from IRS Free File:. What Is IRS Free File?. Guided Tax. Preparation (for AGI $73,000 or less). How IRS Free. File Offers Work. About IRS Free File Partnership with Online Tax Preparation Companies. What You Need to Get Started. Related Tools and Information. The Benefits of the Free File Program to You: BodyWelcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free

Matching search results: WebNov 21, 2022 · To sign your electronic tax return, use a 5 digit self-select PIN, any five numbers (except all zeros) that you choose which serves as your electronic signature. If you do not know last year’s AGI, have a copy of your prior year tax return, you can find that information by signing into your online account. This is the fastest and easiest way ... ...

Top 2: Tax FoundationAuthor: taxfoundation.org - 40 Rating

Description: Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. State Tax Changes Taking Effect January 1, 2023. Return to R&D Expensing Crucial for Manufacturing and. Technology Investment. The Latest on the Global Tax Agreement: The EU Adopts Pillar Two. Prospects for Federal Tax and Budget Policy after the 2022 Midterms. 2023 State Business Tax Climate Index. International Tax Competitiveness Index 2022. 10 Tax Reforms for Growth and Opportunity. Eight State Tax. Reforms for Mobility and Modernization. Tariffs Are Taxes Too. Join over 50,000 Subscribers!. Taxes in Everything:. Die Hard Edition. State Tax Changes Taking Effect January 1, 2023. Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal. Digital Services Taxes: Is There an End in Sight?.

Matching search results: WebAbout Us. The Tax Foundation is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels. ...

Top 3: Tax Exempt Organization Search | Internal Revenue ServiceAuthor: irs.gov - 129 Rating

Description: Tax Exempt Organization Search Tool. Tax Exempt. Organization Search Bulk Data Downloads. Cumulative Data Files Data Updates DelayedExpect delays in data updates for the Tax Exempt Organization Search tool. We are still processing paper-filed 990 series received 2021 and later.System Limitations Cause Some Inaccurate Revocation DatesOrganizations on the auto-revocation list with a revocation date between April 1 and July 14, 2020, should have a. revocation date of July 15, 2020. See Revocation Da

Matching search results: WebTax Exempt Organization Search Tool. You can check an organization's eligibility to receive tax-deductible charitable contributions (Pub 78 Data). You can also search for information about an organization's tax-exempt status and filings: Form 990 Series Returns; Form 990-N (e-Postcard) Pub. 78 Data; Automatic Revocation of Exemption List ...

Top 4: How do I find my employer's EIN or Tax ID? - IntuitAuthor: ttlc.intuit.com - 179 Rating

Description: Where else can I find my employer's EIN while I'm waiting for my W-2? The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. Look for a 9-digit number with a dash separating the second and third digit (NN-NNNNNNN). It's usually right above your. employer's name or below their address.Don't have your W-2 yet? It's best to wait until you get it, either in the mail or electronically (if your company offers e-delivery).

Matching search results: WebSep 08, 2022 · The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form.Look for a 9-digit number with a dash separating the second and third digit (NN-NNNNNNN). ...

Top 5: How do I find last year's AGI? - IntuitAuthor: ttlc.intuit.com - 161 Rating

Description: I filed my 2020 taxes with TurboTax. I didn't file my 2020 taxes with TurboTax and/or I don't have my 2020 return. I still can't find my AGI To find last year's adjusted gross income (AGI), select the option below that best describes your situation.I filed my 2020 taxes with TurboTaxSign in to your TurboTax account. Go to Tax Home if you're not there alreadyScroll down to Your tax returns & documentsSelect View adjusted gross income (AGI) If you've already filed your 2021 tax return, yo

Matching search results: WebIf you have your 1040 or 1040NR return you filed with the IRS for 2020, look on Line 11 for your AGI.. If you don’t have your 2020 return, order a free digital transcript of your return from the IRS Get Transcript site. You can view your online transcript immediately, while the mailed transcript takes 5–10 days to receive. ...

Top 6: Publication 17 (2022), Your Federal Income Tax - IRS tax formsAuthor: irs.gov - 98 Rating

Description: Publication 17 - Introductory Material. Part One - The Income Tax Return. 1. Filing Information. 4. Tax Withholding and Estimated Tax. Part Two - Income and Adjustments to Income. Table V. Other Adjustments to Income. 5. Wages, Salaries, and Other Earnings. 7. Social Security and Equivalent Railroad Retirement Benefits. 9. Individual Retirement Arrangements (IRAs). Part Three - Standard Deduction, Itemized Deductions, and Other. Deductions. 10. Standard Deduction. 12. Other Itemized Deductions. Part Four -. Figuring Your Taxes, and Refundable and Nonrefundable Credits. 13. How To Figure Your Tax. 14. Child Tax Credit and Credit for Other Dependents. Publication 17 - Additional Material. Table 1-5. When To File Your 2022 Return. Worksheet 2-1. Cost of Keeping Up a Home. Worksheet 3-1. Worksheet for Determining Support. Worksheet 5-1. Figuring the Cost of Group-Term Life Insurance To Include in Income. Worksheet 5-1. Figuring the Cost of Group-Term Life Insurance To Include in Income—Illustrated. Table 6-1. Who Pays the Tax on U.S. Savings Bond Interest. Worksheet 9-1. Figuring Your Modified AGI. Worksheet 9-2. Modified AGI for Roth IRA Purposes. 2022 Standard Deduction Tables. Worksheet 11-1. Figuring Your State and Local Real Estate Tax Deduction. Table 11-1. Which Taxes Can You Deduct?. Publication 17 Changes. Do I. Have To File a Return?. Individuals—In General. Surviving Spouses, Executors, Administrators, and Legal Representatives. U.S. Citizens and Resident Aliens Living Abroad. Residents of Puerto Rico. Individuals With Income From U.S. Possessions. Certain Children Under Age 19 or Full-Time Students. Self-Employed Persons. Table 1-2. 2022 Filing Requirements for Dependents. Why Should I File Electronically?. Table 1-4. Free Ways To e-file. Using Your Personal Computer. Through Employers and Financial Institutions. Free Help With Your Return. Using a Tax Professional. When Do I Have To File?. Extensions of Time To File. Individuals Outside the United States. Individuals Serving in Combat Zone. How Do I Prepare My Return?. Table 1-6. Six Steps for Preparing Your Paper Return. When Do I Report My Income and Expenses?. Social Security Number (SSN). Presidential Election Campaign Fund. Installment Agreement. Gift To Reduce Debt Held by the Public. What Happens After I File?. What Records Should I Keep?. Kinds of Records To Keep. How Long To Keep Records. What if I Made a Mistake?. Amended Returns and Claims for Refund. Married Filing Jointly. Filing a Joint Return. Married Filing Separately. Joint Return After Separate Returns. Separate Returns After Joint Return. Qualifying Surviving Spouse. Table 3-1. Overview of the Rules for Claiming a Dependent. Dependent Taxpayer Test. Citizen or Resident Test. Support Test (To Be a Qualifying Child). Joint Return Test (To Be a Qualifying Child). Qualifying Child of More Than. One Person. Not a Qualifying Child Test. Member of Household or Relationship Test. Support Test (To Be a Qualifying Relative). Don’t Include in Total Support. Multiple Support Agreement. Support Test for Children of Divorced or Separated Parents (or Parents Who Live Apart). Social Security Numbers (SSNs) for Dependents. Tax Withholding for 2023. Determining Amount of Tax Withheld Using Form W-4. Changing Your Withholding. Checking Your Withholding. Completing Form W-4 and Worksheets. Getting the Right Amount of Tax Withheld. Rules Your Employer Must Follow. Exemption From Withholding. Taxable Fringe Benefits. Pensions and Annuities. Unemployment Compensation. Estimated Tax for 2023. Who Doesn't Have To Pay Estimated Tax. Who Must Pay Estimated Tax. How To Figure Estimated Tax. When To Pay Estimated Tax. How To Figure Each Payment. Estimated Tax Payments Not Required. How To Pay Estimated Tax. Credit an Overpayment. Pay by Check or Money Order Using the Estimated Tax Payment Voucher. Credit for Withholding and Estimated Tax for 2022. Form. Received After Filing. Underpayment Penalty for 2022. Employee Compensation. Miscellaneous Compensation. Accident or Health Plan. De Minimis (Minimal) Benefits. Educational. Assistance. Group-Term Life Insurance. Retirement Planning Services. Retirement Plan Contributions. Special Rules for Certain Employees. Members. of Religious Orders. Sickness and Injury Benefits. Military and Government Disability Pensions. Long-Term Care Insurance Contracts. Workers' Compensation. Other Sickness and Injury Benefits. Education Savings Bond Program. U.S. Treasury Bills, Notes, and Bonds. Bonds Sold Between Interest Dates. State or Local Government Obligations. Original Issue Discount (OID). When To Report Interest Income. How To Report Interest Income. Are Any of Your Benefits Taxable?. How To Report Your Benefits. Deductions Related to Your Benefits. Repayments More Than Gross Benefits. Life Insurance Proceeds. Endowment Contract Proceeds. Accelerated Death Benefits. Public Safety Officer Killed or Injured in the Line of Duty. Itemized Deduction Recoveries. Rents From Personal Property. Unemployment Benefits. Welfare and Other Public Assistance Benefits. Who Can Open a Traditional IRA?. When and How Can a Traditional IRA Be Opened?. How Much Can Be Contributed?. When Can Contributions Be Made?. How Much Can You Deduct?. Are You Covered by an Employer Plan?. For Which Year(s) Are You Covered?. Situations in Which You Aren’t Covered. Limit if Covered by Employer Plan. Reporting Deductible Contributions. Nondeductible Contributions. Can You Move Retirement Plan Assets?. Trustee-to-Trustee. Transfer. Rollover From One IRA Into Another. Rollover From Employer's Plan Into an IRA. Transfers Incident to Divorce. Converting From Any Traditional IRA to a Roth IRA. When Can You Withdraw or Use IRA Assets?. When Must You Withdraw IRA Assets?. (Required Minimum Distributions). Are Distributions Taxable?. Distributions Fully or Partly Taxable. What Acts Result in Penalties or Additional Taxes?. Prohibited Transactions. Investment in Collectibles. Excess Accumulations (Insufficient Distributions). Reporting Additional Taxes. When Can a Roth IRA Be Opened?. Can You Contribute to a Roth IRA?. How Much Can Be Contributed?. When Can You. Make Contributions?. What if You Contribute Too Much?. Can You Move Amounts Into a Roth IRA?. Rollover From a Roth IRA. Are Distributions Taxable?. Standard Deduction Amount. Higher Standard Deduction for Age (65 or Older). Higher Standard Deduction for Blindness. Spouse 65 or Older or Blind. Higher Standard Deduction for Net Disaster Loss. Standard Deduction for Dependents. Tests To Deduct Any Tax. State and Local Income Taxes. State and Local General Sales Taxes. State and Local Real Estate Taxes. Real Estate-Related Items You Can’t Deduct. Personal Property Taxes. Taxes and Fees You Can’t Deduct. Miscellaneous Itemized Deductions. Unreimbursed. Employee Expenses. Categories of Employment. Expenses You Can’t Deduct. Miscellaneous Deductions Subject to 2% AGI. Casualty and Theft Losses. Clerical Help and Office Rent. Credit or Debit Card Convenience Fees. Depreciation on Home Computer. Fees To Collect Interest and Dividends. Indirect Deductions of Pass-Through Entities. Investment Fees and Expenses. Repayments of Social Security Benefits. Safe Deposit Box Rent. Service Charges on Dividend Reinvestment Plans. Trustee's Administrative Fees for IRA. Nondeductible Expenses. List of Nondeductible Expenses. Check-Writing Fees on Personal Account. Investment-Related Seminars. Life Insurance Premiums. Lost or Mislaid Cash or Property. Lunches With Co-Workers. Meals While Working Late. Personal Legal Expenses. Political Contributions. Professional Accreditation Fees. Professional Reputation. Relief Fund Contributions. Residential Telephone Service. Stockholders' Meetings. Tax-Exempt Income Expenses. Travel Expenses for Another Individual. Voluntary. Unemployment Benefit Fund Contributions. Expenses You Can Deduct. Amortizable Premium on Taxable Bonds. Casualty and Theft Losses of Income-Producing Property. Excess Deductions of an Estate or Trust. Federal Estate Tax on Income in Respect of a Decedent. Gambling Losses up to the Amount of Gambling Winnings. Impairment-Related Work Expenses. Repayments Under Claim of Right. Unlawful Discrimination Claims. Unrecovered Investment in Annuity. Alternative Minimum Tax (AMT). Form 1040 or 1040-SR Line Entries. Taxpayer Identification Number Requirements. Child Tax Credit (CTC). Qualifying Child for the CTC. Credit for Other Dependents (ODC). Qualifying Person for the ODC. Limits on the CTC and ODC. Claiming the CTC and ODC. Additional Child Tax Credit (ACTC). Your Rights as a Taxpayer. The Taxpayer Bill of Rights. Examinations (Audits). Taxpayer Advocate Service. The Taxpayer Advocate Service (TAS) Is Here To Help You. How Can You Learn About Your Taxpayer Rights?. What Can TAS. Do for You?. How Else Does TAS Help Taxpayers?. TAS for Tax Professionals. Low Income Taxpayer Clinics (LITCs). Table 2-1. Who Is a Qualifying Person Qualifying You To File as Head of Household?1. Table 9-3. Effect of Modified AGI on Roth IRA Contribution.

Matching search results: Web2023 modified AGI limits. You can find information about the 2023 contribution and AGI limits in Pub. 590-A. ... Don't attach the previously filed tax return, but do include copies of all Forms W-2 and W-2G for both spouses and any Forms 1099 that show income tax withheld. The processing of Form 8379 may be delayed if these forms aren’t ... ...

Top 7: Offer in Compromise FAQs | Internal Revenue Service - IRS tax formsAuthor: irs.gov - 153 Rating

Description: The number of Forms 656, application fees, and offer payments required are based on the types of taxes you want to compromise. The following number of Forms 656, application fees, and offer payments must be sent with the offer (unless payment is not required because you qualify for the Low Income Certification box in Section. 1 of the Form 656 and check the box):One Form 656 with one application fee and one offer payment if you are compromising either your individual tax liability or two taxpayer

Matching search results: WebYou qualify if your adjusted gross income (AGI), as determined by your most recently filed income tax return (Form 1040 or 1040-SR), is less than or equal to the amount shown in the chart on Form 656, Section 1, based on your family size and where you live. ...

Top 8: 2021 Adjusted Gross Income or AGI For The 2022 Tax Return - e-FileAuthor: efile.com - 117 Rating

Description: How to Obtain, Find Your 2021 Tax Return AGI. Steps to Enter. Your 2021 Adjusted Gross Income on eFile.com Important Note: The IRS - not eFile.com - has not processed all 2021 Returns as of October 2022, thus not all 2021 AGIs are up-to-date at the IRS. As a result, you might be required to take these steps to get your 2021 validated. What is your Adjusted Gross Income and why is it needed? Your Adjusted Gross Income (AGI) is your total gross income minus certain deductions, which red

Matching search results: Web1) If you e-Filed your 2021 Tax Return on eFile.com, sign into your eFile.com account and view and/or download your PDF tax return file from the My Account page. Find your prior-year AGI on Line 11 of your 2021 Form 1040. 2) If you filed elsewhere and you have a copy of your 2021 Tax Return, find your AGI on Line 11 of IRS Form 1040, 1040-SR ... ...

Top 9: Tax Return Rejection Codes by IRS and State: How to Re-FileAuthor: efile.com - 120 Rating

Description: Online eFile Tax Return Rejection Codes Online eFile Tax Return Rejection Codes. If your tax return got rejected by the IRS or state, search the rejection code below for detailed instructions on how to correct your tax return. Don't worry: a rejection of an e-filed tax return usually requires only a small correction. You can then re-efile at no additional charge. If you did not prepare and e-file your tax return through eFile.com, you can still search the. rejection codes below as they are the

Matching search results: WebHere are three ways to locate your 2020 Adjusted Gross Income, AGI: 1) If you e-Filed your 2020 Tax Return on eFile.com, sign into your eFile.com account and View and/or download your PDF tax return file from the My Account page. Find your prior-year AGI on Line 11 of your 2020 Form 1040. ...

Top 10: How to Find Your Adjusted Gross Income (AGI) to E-file Your Tax ...Author: turbotax.intuit.com - 197 Rating

Description: File 100% FREE with expert help. Importance of the AGI. TaxCaster Tax Calculator. Tax Bracket. Calculator. W-4 Withholding Calculator. Self-Employed Tax Calculator. Self-Employed Tax Deductions Calculator TopTurboTax /Tax Calculators & Tips /Tax Tips Guides & Videos /IRS Tax Return /How to Find Your Adjusted Gross Income (AGI) to E-file Your Tax ReturnUpdated for Tax Year 2022 • December 1, 2022 09:16 AMOVERVIEWYour adjusted gross income (AGI) is an important number come tax. time, espec

Matching search results: Dec 1, 2022 · For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040NR. It is located on different lines on forms from earlier years. • ...Dec 1, 2022 · For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040NR. It is located on different lines on forms from earlier years. • ... ...

Top 11: How do I find last year's AGI? – Tax Guide • 1040.comAuthor: 1040.com - 122 Rating

Description: Updated for filing 2021 tax returnsTo find your prior-year Adjusted Gross Income (AGI), look on a copy of the tax return you filed last year.Your 2020 AGI will be on Line 11 of Form 1040.If you filed with 1040.com, we’ll automatically carry forward your prior-year AGI to validate your identity when you file this year. You can also sign in and view a completed copy of your return from last year. In the upper left-hand corner of the PDF, you. will see which main tax form your return was filed on.St

Matching search results: To find your prior-year Adjusted Gross Income (AGI), look on a copy of the tax return you filed last year. Your 2020 AGI will be on Line 11 of Form 1040.To find your prior-year Adjusted Gross Income (AGI), look on a copy of the tax return you filed last year. Your 2020 AGI will be on Line 11 of Form 1040. ...

Top 12: 2021 Adjusted Gross Income or AGI For The 2022 Tax ReturnAuthor: efile.com - 108 Rating

Description: How to Obtain, Find Your 2021 Tax Return AGI. Steps to Enter. Your 2021 Adjusted Gross Income on eFile.com Important Note: The IRS - not eFile.com - has not processed all 2021 Returns as of October 2022, thus not all 2021 AGIs are up-to-date at the IRS. As a result, you might be required to take these steps to get your 2021 validated. What is your Adjusted Gross Income and why is it needed? Your Adjusted Gross Income (AGI) is your total gross income minus certain deductions, which red

Matching search results: Depending on the tax year, your AGI is on your Form 1040, somewhere around Lines 10-14 and says "This is your adjusted gross income". The 2021 AGI amount is on ...Depending on the tax year, your AGI is on your Form 1040, somewhere around Lines 10-14 and says "This is your adjusted gross income". The 2021 AGI amount is on ... ...

Top 13: How Do I Get My AGI From Last Year? - H&R BlockAuthor: hrblock.com - 163 Rating

Description: How to Locate Your Previous Year AGI If You Don’t Have Access to Your Return If you’re e-filing your return, the IRS will verify your identity by using your personal tax information from the previous year. Specifically, when you file your return, the IRS compares these two things to see if they match:The prior-year adjusted gross income (AGI) you enteredYour prior-year tax recordsIf these don’t match, the IRS will reject your return. In most cases, you can easily fix this issue and successfully

Matching search results: How to Locate Your Previous Year AGI If You Don't Have Access to Your Return · View or download a transcript of your return online at www.irs.gov. · Go to www.irs ...How to Locate Your Previous Year AGI If You Don't Have Access to Your Return · View or download a transcript of your return online at www.irs.gov. · Go to www.irs ... ...

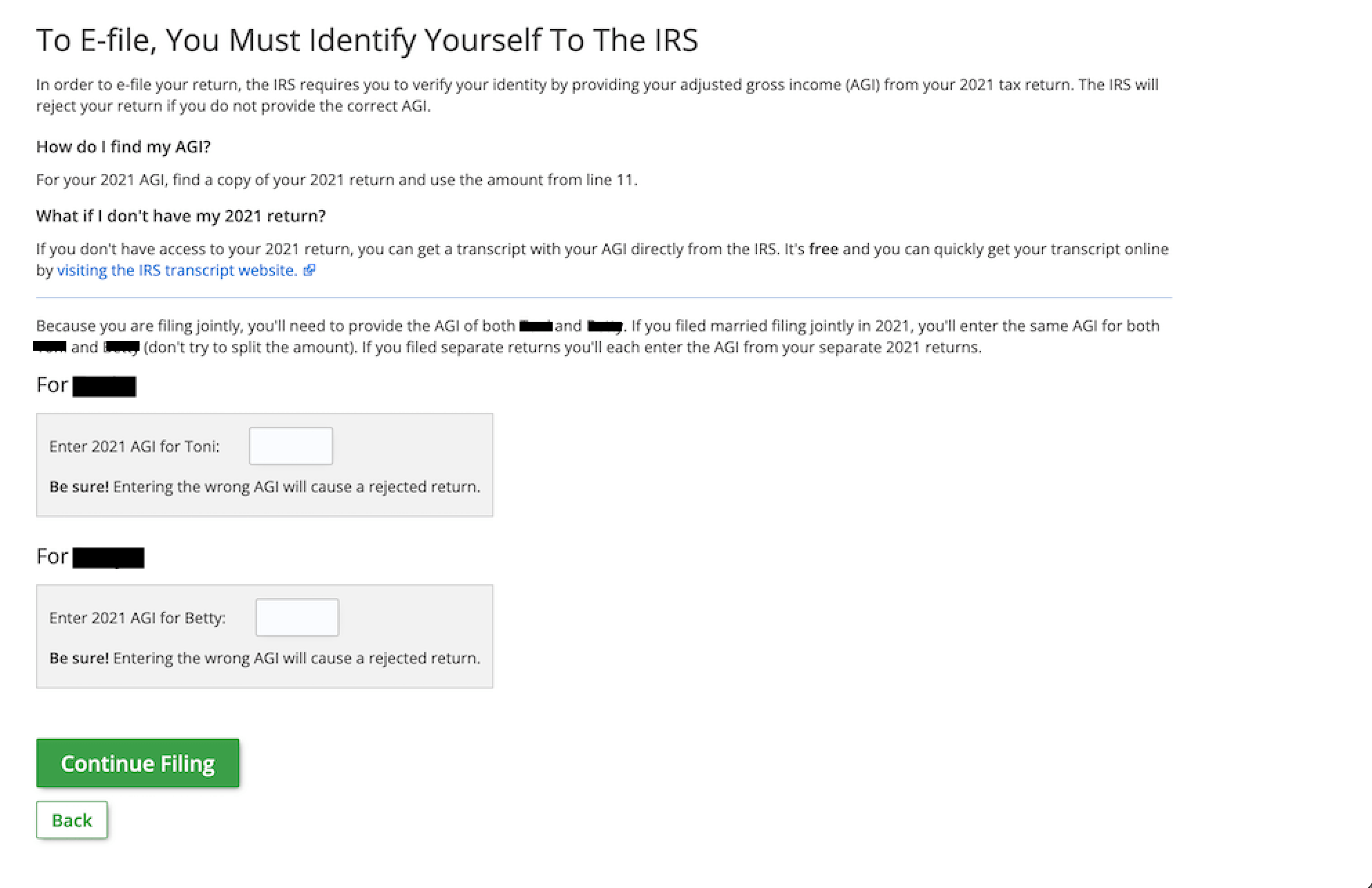

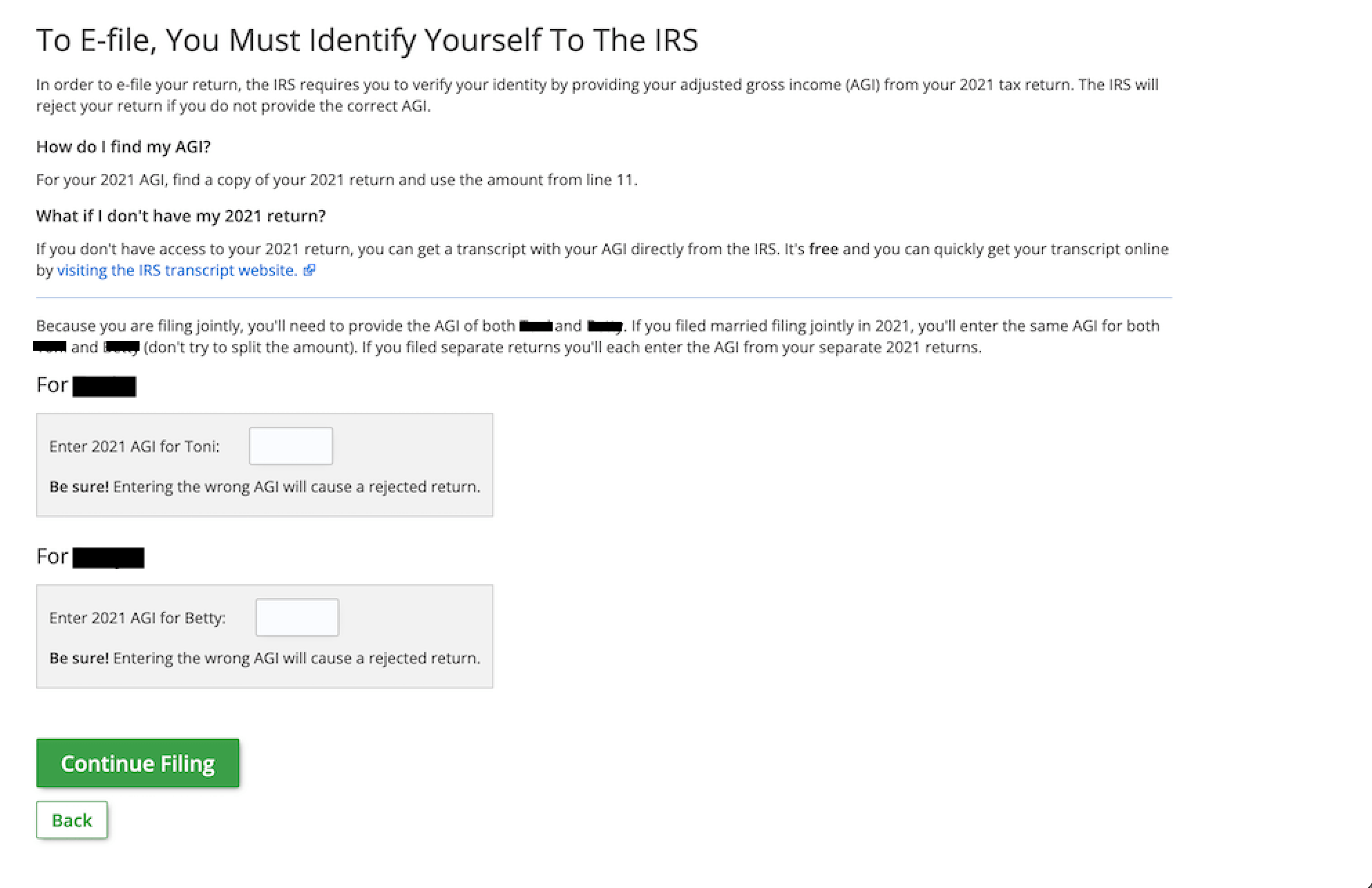

Top 14: Where can I find last year's Adjusted Gross Income (AGI)?Author: myfreetaxes.com - 159 Rating

Description: Have a question or need some help? We're here for you.. Search our frequently asked questions below. Contact us to receive assistance from or Support Team SupportHave a question or need some help? We're here for you.Search our frequently asked questions belowContact us to receive assistance from or Support TeamCall our HelplineSend us a messageThe IRS recommends a few options for obtaining your prior-year AGI.Preferred Method You should always retain a copy of your tax return. On your prior-yea

Matching search results: You should always retain a copy of your tax return. On your prior-year tax return, your AGI is on line 8b of the Form 1040. If you are using the same tax ...You should always retain a copy of your tax return. On your prior-year tax return, your AGI is on line 8b of the Form 1040. If you are using the same tax ... ...

Top 15: Adjusted Gross Income (AGI): What It Is, How to DetermineAuthor: nerdwallet.com - 123 Rating

Description: What is adjusted gross income?. How is adjusted gross income calculated?. Where is AGI on a tax return? The significance of adjusted gross income. What is your modified adjusted. gross income (MAGI)? What is adjusted gross income?Adjusted gross income, or AGI, is your gross income minus certain adjustments. The IRS uses this number as a basis for calculating your taxable income. AGI can also determine which deductions and credits you may qualify for.How is adjusted gross income calculated?Adju

Matching search results: Nov 18, 2022 · You can find your adjusted gross income right on your IRS Form 1040. On your federal tax return, your AGI is usually on line 11 of your Form ...Nov 18, 2022 · You can find your adjusted gross income right on your IRS Form 1040. On your federal tax return, your AGI is usually on line 11 of your Form ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 paraquee Inc.